(Il Sole 24 Ore Radiocor Plus) – Milan, 17 April – Prime Minister Giuseppe Conte says not to worry too much now about what the new ESM proposal contains: we approve the reform and, anyway, we will always have the option, but not the obligation, whether or not to access this facility. This type of approach, however, is incorrect, because even the simple approval of the new ESM, on April 23, could have negative implications, not neutral as one would think, for our country. Why?

First of all, a country that accesses the ESM signals a difficulty in obtaining funds on the international debt markets. To date, Italy has full access to bond markets. But accepting in principle the possibility, not clearly denied, of accessing the ESM raises the perceived country risk and this causes the return on our current bond stock to increase because the markets assume that MES access is now no longer as impossible as it is today. Those who object say that the impact on the yield of the existing debt is not high because we are talking about a ratio between 36bn of the ESM and the 2,400bn of existing debt. And they are right. But it is this very high ratio that causes a small change of only 2 basis points (0.02%) in the yield of our debt to nullify all the potential savings that accessing the ESM on preferential terms (130 points less and savings of 470 million) would entail.

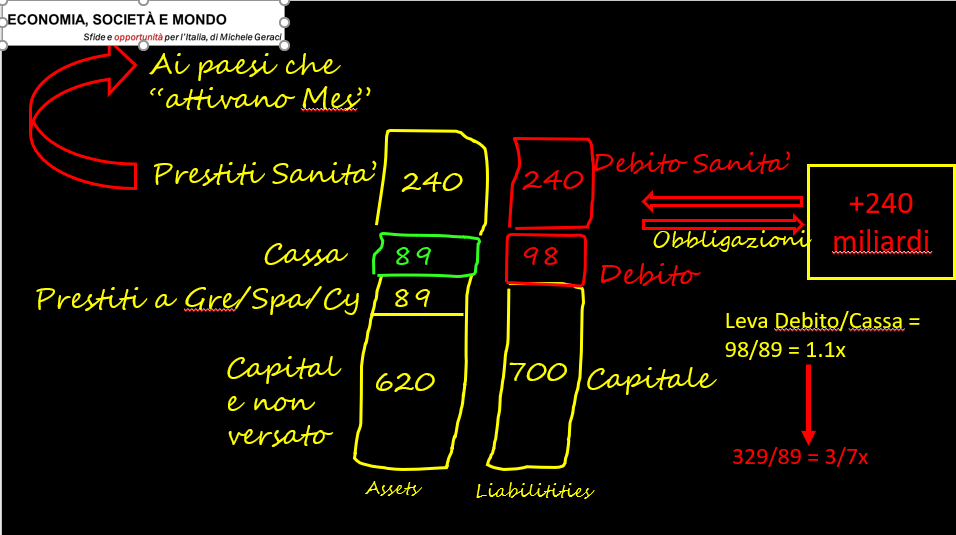

Second point: to date, the capital paid in by the 19 countries and in the funds of the ESM is 80 billion, the ESM has issued bonds for 98 billion, of which it has used 89 to support Spain, Greece and Cyprus, there are about another 89 of cash, which act as collateral for the 98 billion bonds. The proposal provides for an additional debt of the ESM up to 240 billion (2% GDP Eurozone), therefore the liabilities of the ESM go from the current 98 billion to 378 billion and, it is assumed that the new sum, 240 billion, will be used by the 19 countries (otherwise the issue would be lower). The new ESM balance sheet would therefore be 378 billion in debt and 89 in cash. A lever that becomes problematic. Not only for the debt / cash ratio that goes from 1.1x to 3.7x, but also because the Eurogroup proposal transforms the ESM into a tool to be used to protect the system from asymmetric risks to a support mechanism for symmetric risks. The new, higher, leverage, and risk symmetry which, paradoxically, makes the MES a riskier organization than before, would make a recapitalization of the MES necessary or likely. And therefore, member states could be forced to put their hands on their pockets and replenish the equity and the cash of the ESM. For Italy, the bill could be as high as 36 billion (I conservatively estimate a bit less, around 10bn), to be paid immediately without saying a word, before even deciding whether to access the lending facility with “strict conditions” as stated in article 136 of the TFEU.

In summary, if the Council approves the change but Italy does not have to take out the loan, we will have to start paying more for both interest and capital, in exchange for nothing. If we change our mind and borrow the 36 billion, we will also have the Troika at home, always in exchange for nothing. I advise the PdC not to accept the “Healthcare” boomerang.