If a Japanese tourist in Paris buys an Italian fashion product on the Champs-Élysées, how would it be more appropriate to record this event on export statistics? As an export from Italy to France, or as an export from Italy to Japan? If an American citizen is in Italy and follows a language course in Rome, would it be more appropriate to register it as an export from Italy to the USA or as internal consumption, given that the service provided does not cross the border? And if an auto parts company sells its products to BMW, which then uses those components to produce cars sold to Chinese consumers, do we register it as an export from Italy to Germany or China?

In a globalized economy with a complex global value chain, the official bilateral statistics on foreign trade on which the export promotion strategies and the allocation of funds of the Ministry of Foreign Affairs promotion plan are based, therefore lose their value. original and, if not completed by further analyzes, they risk providing a distorted picture of reality with serious consequences on the efficiency of the Italian System’s efforts. The solution we propose is therefore to use the official statistics as a starting point, but to integrate them with all the flows of goods and intermediate services, triangulations, purchases on the Italian territory by non-residents and more, to arrive at a new estimate. of our business partners who are no longer based on who is the first importing country from Italy, but rather on who our final customers are.

A preliminary analysis of ours, already discussed right here on MilanoFinanza, gave us a general picture at the level of the continents where our products are consumed: significant differences were already emerging in the ranking of our commercial partners: Europe was retreating, while America and Asia were rising. of importance. An unsurprising result due to the fact that part of our exports to European countries are nothing more than transshipment (as in the case of the large ports of Rotterdam and Antwerp) or supplies of components then used in products sold in the two major world markets, the United States and Asia, in fact. And, conversely, many of the Made in Italy products consumed by Americans and Asians are not reported in the official bilateral statistics to those countries.

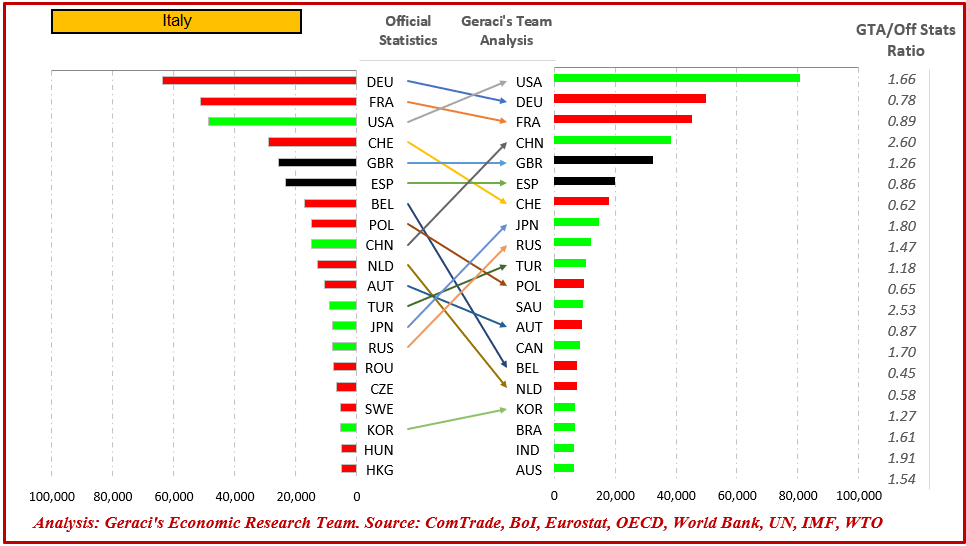

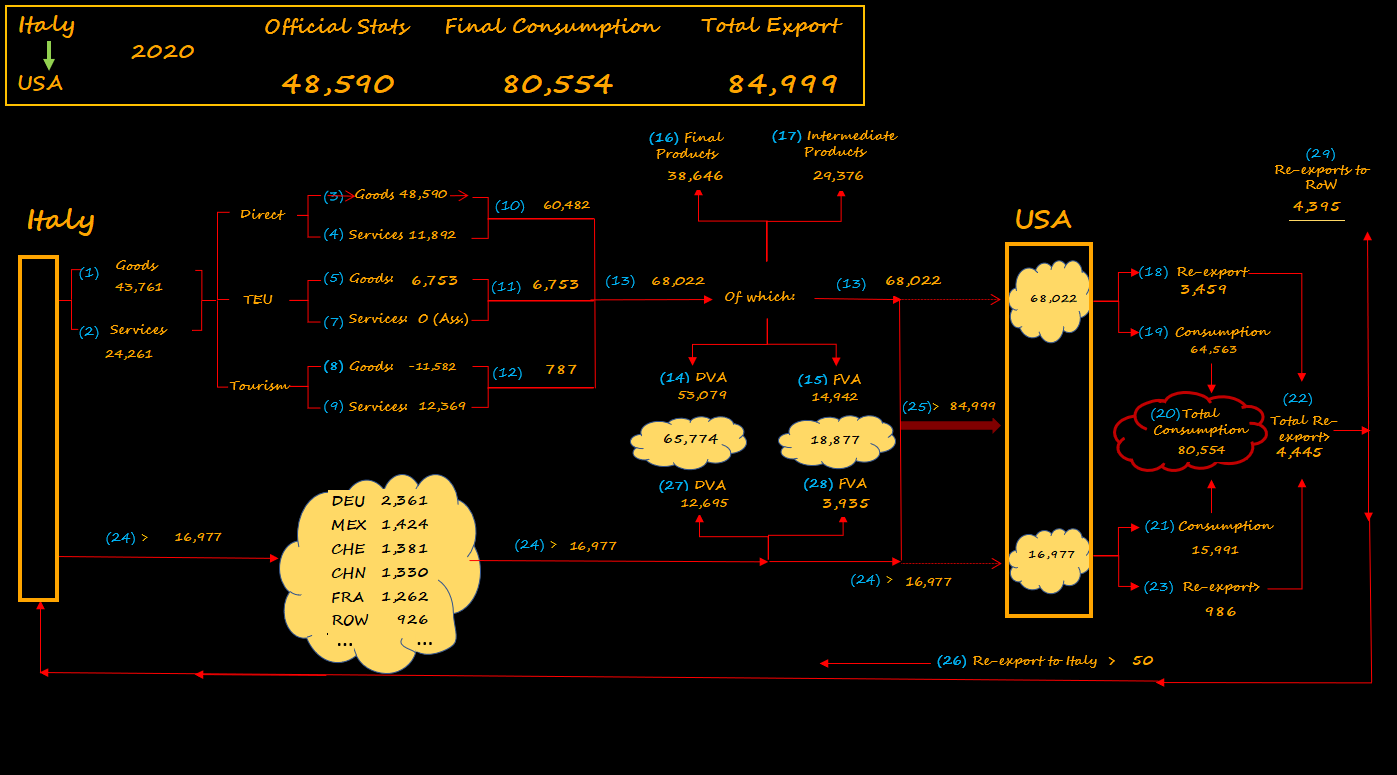

The detailed analysis for individual countries has just ended and aroused interest from the new Director General of the WTO, Dr. Ngozi, whom I recently met in Geneva. This analysis confirms what has been observed at the continent level and provides a very different picture of the ranking of our real trading partners from what is shown in the initial bilateral statistics. With reference to the flows of 2020, already distorted by the Covid effect, the top 5 final customers of Made in Italy are not, as is supposed, 1) Germany, 2) France, 3) USA, 4) Switzerland and 5 ) Great Britain, but, in order: 1) USA, 2) Germany, 3) France, 4) China and 5) Great Britain. Hence, the United States is the largest consumer of our products with purchases of $ 80bn, compared to $ 48 in official statistics, an increase ratio of 1.6x, thus beating Germany and France, which instead retreat from $ 63bn and $ 51bn, respectively. , at $ 49bn and $ 45, equivalent to ratios, this time lower than one, equal to 0.88 for France and 0.78 for Germany, confirming the great role that Germany, and also Switzerland, plays in buying from Italy , reprocess and re-export to other end customers. While the US therefore consolidated itself as the first undisputed customer with a gap on the second market, Germany, of as much as $ 30bn, the other big news (so to speak) is the rise of China, from ninth official place to fourth, and going from an official value of $ 14.5bn to $ 38bn, an increase ratio of 2.6x, very high. In practice, China is worth for our exports, and therefore for our economy, almost three times what is believed.

This reallocation of the ranking of our commercial partners should suggest important reflections: 1) How to reshape the promotion budget which includes trade fairs, promotion on e-commerce platforms and large-scale distribution initiatives (GDO), to raise awareness of those final customers, without, of course, neglecting whoever acts as a bridge. 2) Understand if it is possible and useful to try, for example, to bypass countries, such as Holland and Belgium, whose ports act as bridges, transshipment, and try to reach end customers directly, thus avoiding leaving value on the table for our companies. So try to increase traffic from our ports, a strategy that was the basis of the MoU Silk Road signature that would have given greater competitiveness to our ports in the north east and north west. 3) Deeply analyze the global value chain to understand if it is possible to address end customers even bypassing those countries, such as Germany, which import our intermediate products to include them in their products and resell them in China. In other words, to understand what the rest of the world sells to the USA and China, using our pieces, and to invest and develop industries in our territory that can produce that missing part to have in our hands not only the production of intermediate products but also of final products, appropriating the entire value chain, a strategy also at the basis of Biden’s reforms.

All complex things, of course, easier to write than to make them. But I believe they are among the many initiatives that our country system must look at with due care and with the utmost urgency and I therefore launch an appeal to the ministers of Maio, Garavaglia, Giorgetti and Giovannini so that no more time is wasted. Also because, other countries are doing the same mirror analyzes, from their points of view, to compete with us. And frankly, with domestic demand that is difficult to recover, an investment plan whose results on GDP will only be seen over time, exports remain our only chance to keep both the economy and our society afloat.

Looking at the complete ranking of the top 20 trading partners, in addition to the USA and China, all Asian countries move up in the ranking, Japan, Korea, India, as well as Russia and Turkey which have mixed dynamics, while all European countries drop in the ranking: beyond to the already discussed Germany, France, Switzerland, also Spain, Belgium, Holland, Poland, Romania, Sweden and the Czech Republic. A very clear picture that confirms that a recovery of our economy is essential from the USA and Asia. It is therefore in the interest of our country, our companies and our workers to keep the tones low, not to get carried away by the search for electoral consensus, launching unlikely offenses to those who buy our products and follow the example of the PdC Draghi who reaffirms our undisputed geopolitical alliance with the USA, but with the awareness of the importance of other markets.

PLEASE NOTE